Posted by mybudget360

What if I told you that you can live well in California with an income of less than $50,000 a year? A budget of this kind is not some sort of financial bait and switch but a realistic budget that many frugal people use on a daily basis. California has one of the highest costs of living and if you can figure out how to live here making $46,000 a year, you can live anywhere in this country.

While many working professionals in California struggle with the ability of buying a home, there is a large class of people who are simply dealing with the day to day items of life. In fact, if we look at a county like Los Angeles, the most populous county in Southern California 52.1% of households actually rent. This is significant given the population of this county is approximately 10,000,000 people.

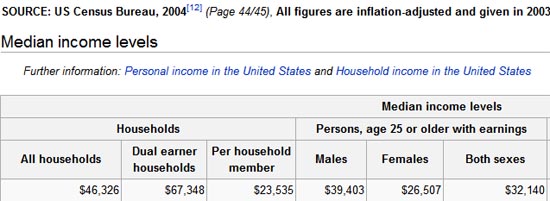

This is not as far fetched as you would suspect. The median household income for the entire United States is $46,326.

The median household income for Los Angeles County in 2004 was $43,518 so our hypothetical budget of $46,000 could apply to 5,000,000 people living in this highly populated area. This probably goes against the wide perception that most people in California are wealthy and live in Beverly Hills, Brentwood, or Laguna Beach but this is a very tiny part of the population. This is not the reality. Many of these working families are simply getting by and have little way of accessing the media to discuss their struggles.

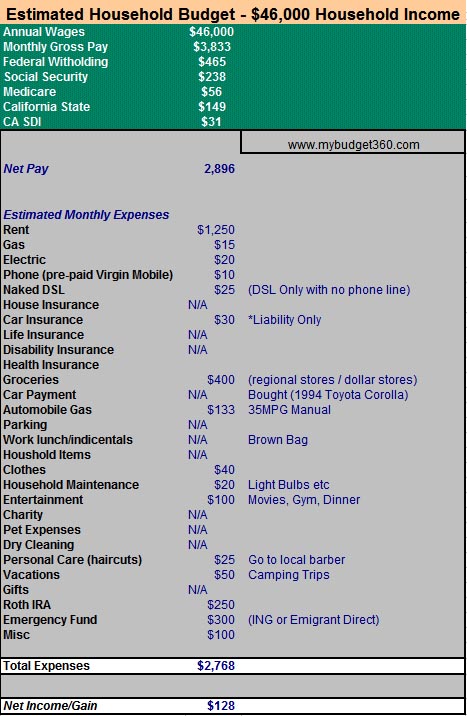

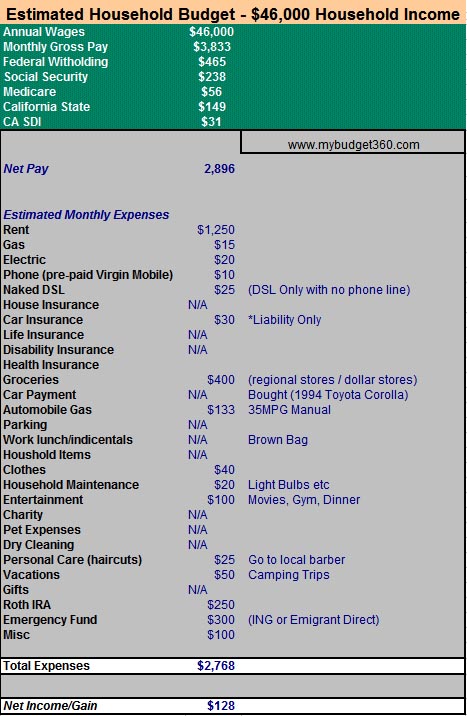

In this article, we are going to provide a full monthly budget for either a single person or working couple that pulls in $46,000 a year. Many families live on this amount. In fact, this works out to be about $11 per hour for 2 full-time workers or one worker pulling in $22 per hour. First, let us provide the full monthly budget and discuss the line items in greater detail:

Now I know there have been many budgets put out on various finance and housing sites yet they really do not point you in the right direction as to where to find information. After all, where do you find a fuel economical car for $3,000? Or where can you shop for groceries and pay $400 a month to take care of breakfast, lunch and dinner? We will go into the details of the budget above. Make no mistake, this is a minimalist budget here. You won’t be buying a McMansion here but you won’t be drowning in debt either. With this budget, you are even saving! So if you find yourself in a situation like this, you may want to consider some of the items on the list.

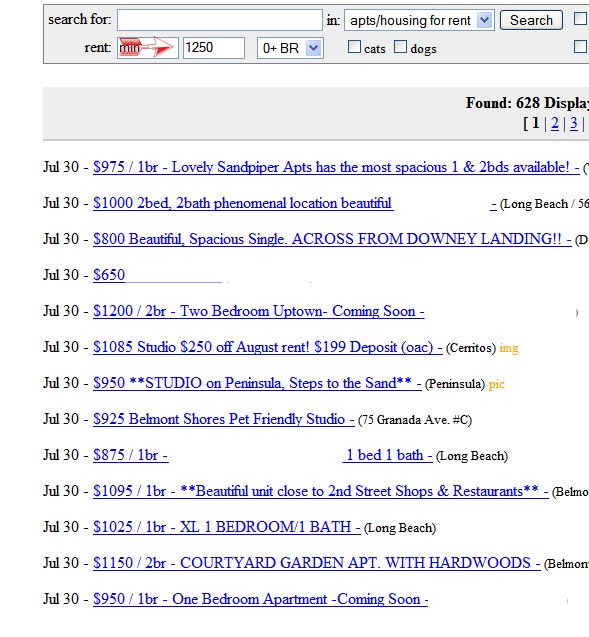

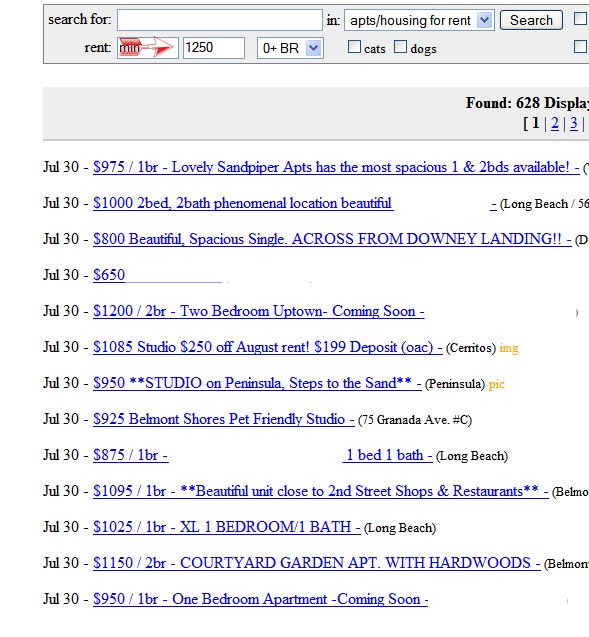

The most expensive line item of any California resident is housing. With $46,000 you shouldn’t even consider buying a home since it will sink you. In fact, many people did buy homes with this kind of budget and now find themselves part of the problems the state is facing. With this kind of budget you have small room for errors. We are giving this person a $1,250 a month allocation for rent. Believe it or not there are many nice 1 bedroom apartments for this price. Craigslist will be one of your tools for investigating rental properties. Take a look at what I found with a quick query:

you have to manage your expectations. You won’t be renting a beach front home in Newport Coast but you also won’t be living in unsafe neighborhoods. Your quality of life will depend on whether you want a studio, 1 bedroom, or 2 bedrooms home. Also, how close to your work would you like to be?

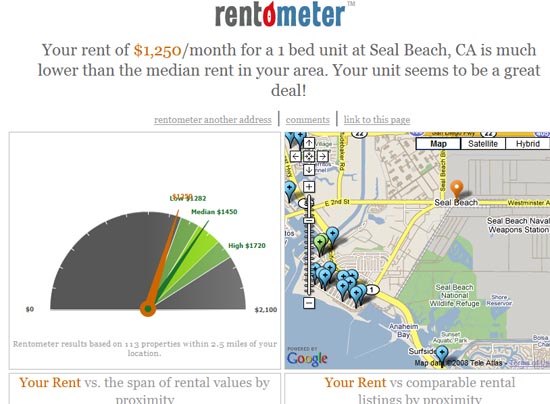

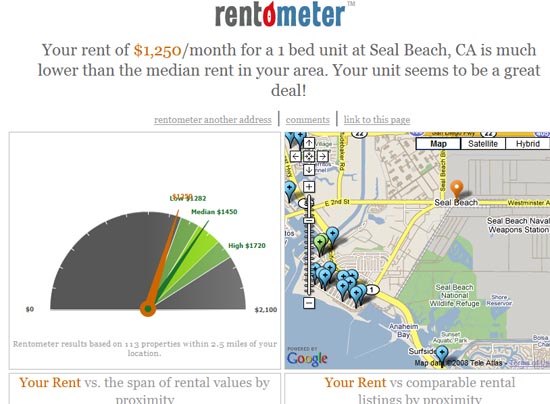

The next tool you’ll be using to find out whether you are paying too much or getting a good deal is Rent-o-meter. With this tool, you simply put the address of the potential rental and it will use Goolge maps to give you a rough estimate of other rentals in the area. For example, let us take a quick look at some rentals in Seal Beach:

After running this quick query, we can determine the market price of homes in this immediate region. Since our budget is sensitive to housing prices, it is important we first manage our expectations in regards to price. But with 88 Cities in Los Angeles County we do have some room for flexibility. It will take some time to research but you will find something safe and comfortable for $1,250 a month.

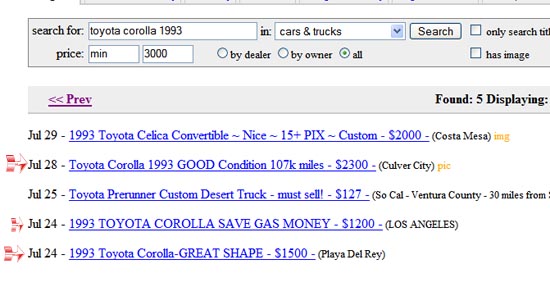

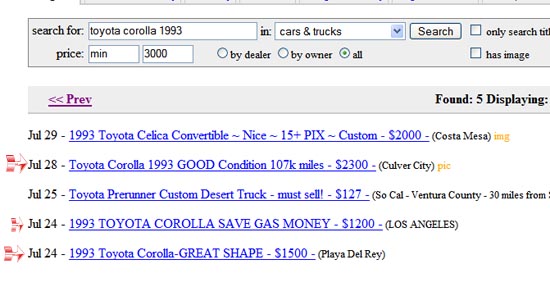

The next major line item we’ll look at is automobile costs. It is hard to get around California with no car. With the cost of fuel soaring, we won’t be purchasing a Hummer. But you can get a reliable fuel efficient car for $3,000 that will cost no more than $133 a month in fuel even with current gas prices. Where can you find such a deal? Once again we’ll look at Craigslist:

First, you need to realistic about what you can buy. For our example, we are looking at purchasing a 1993 Toyota Corolla. You can probably get a 1994 or go with a Honda Civic of the same year and still fall under your $3,000 budget. These cars if you go with the manual version will get you 35 miles per gallon. You are almost getting the efficiency of a hybrid! Plus, if the car is well maintained these things will last you forever. Let us assume you drive to work 15 miles each way. So you put in 30 miles per day 5 times a week. We’ll give you the same for weekend driving:

7 x 30 miles per day = 210 miles per week x 52 weeks = 10,920 miles per year

Monthly miles 10,920 / 12 = 910 miles per month

910 miles per month / 35 miles per gallon = 26 gallons of gas needed

Cost per gallon $4.25 x 26 = $110.50

We’ll give you another $23 bucks in your budget in case you took a longer trip or added a few additional miles. Or, if prices go up, you have a bit of a cushion up until gas hits $5.11 a gallon which is still a distance away. Liability insurance on these cars is minimal and if you have a good driving record, you can get by with $30 a month.

So now we covered two big line items, your transportation and your housing.

Eating is another major item. With $400 you can feed yourself well for a month. Here in California we are fortunate enough to have regional markets that compete with your common supermarkets. What you’ll find in these regional markets is that produce is nearly 40 to 60% cheaper than your common chain markets. Also, you will find better deals on meats. So this is where you will do your shopping. For items like toothbrushes which can go for $6 at a pharmacy store or supermarket, you can go to the 99 Cent store and get a couple. You will also find that these dollar stores carry many items that you’ll need around your house like tools, cleaning supplies, and snacks. These snacks (like yogurts and nutrition bars) can be part of your brown bag lunch.

For breakfast which you shouldn’t skip, you can have a nutritious cereal with fruit or buy some whole grain waffles for the go. You can make sandwiches for lunch with some chips and fruit and you’re good to go. For dinner, with the produce and meat you can make yourself a solid dinner. Listen, you aren’t going to eat Lobster each night but you aren’t eating Top Ramen either. This is doable if you know how to manage your budget.

Most phone companies are trying to sucker people in trying to have them keep their land lines. They’ll do package deals with DSL or cable which make no sense. You can request to have “naked DSL” which is strictly DSL alone. Many companies provide this and you’ll find reasonable rates where $25 per month will keep you connected to the internet. For phone service you are going to have a pre-paid service with Virgin Mobile or T-Mobile which can be as cheap as $10 per month. Places like Virgin Mobile require you to “top-off” your account each few months but is much cheaper than say going with an iPhone and running yourself down $100 for the service. With one month of iPhone service you can pay for nearly a year of pre-paid service with Virgin Mobile. Again, it is learning to control your spending here.

Many apartments will pay for your trash and water service. Electric will be minimal in most cases since our weather in California is perfect nearly year round. If you must, by a fan or go outside. That is after all why you live in California!

We’ve even provided a line item for clothes. Places like Ross and even Old Navy, provide quality clothes at discount prices. You are not going to be shopping at Macys or Nordstrom’s so get used to it! But it doesn’t mean you have to look poor either.

With $100 for entertainment you have some leeway for what you want to do here. You can go to a few movies a month, eat out a couple of times, or even take a nice camping trip. There are many places in Southern California that are actually free and great. You can go to the Getty (free) or go to the great beaches (free as well).

With this budget, we also haven’t forgotten saving for retirement and also building an emergency fund. We are putting away $250 a month into a Roth IRA since many people that are making $11 an hour don’t have options of saving with their company or employer. If you do, this would be preferable since it is taken out before taxes and will increase your take home pay a bit. It is important to remember that you will need to set something aside for your protection down the road.

With your emergency fund, you will save $300 per month in an ING or Emigrant Direct account. There are other online saving accounts but these places have strong balance sheets and aren’t at risk of going belly up like some institutions here in California. After 1 year, you will have approximately 1.5 months of living expenses saved and after 2 years, you will have 3 months saved. Given that you are also saving in your IRA you should have a minor safety cushion after 2 years. Again, we are emphasizing minimalism here.

This budget is put together from personal experience. I know how hard it is to live in California on a tight budget. Any starving college student will tell you this! In fact, many families are living this on a daily basis. The purpose of this article is to offer at least some hope that you can make it on a lower income. There are ways and resources free of charge that are available to you in helping you reach some form of financial stability. This article isn’t intended to cover every unforeseen circumstances since life itself is unpredictable but it should give you a blue print of living life on a tight budget and not feeling like you have to go into more and more debt. Of course to move higher, most likely you will need to further yourself via an education and fortunately through the community college system and our state schools, education is still relatively affordable and there is financial aid. Knowledge is power and given the hard economic times, regardless of your income you should feel in control of your life.

Source:

What if I told you that you can live well in California with an income of less than $50,000 a year? A budget of this kind is not some sort of financial bait and switch but a realistic budget that many frugal people use on a daily basis. California has one of the highest costs of living and if you can figure out how to live here making $46,000 a year, you can live anywhere in this country.

While many working professionals in California struggle with the ability of buying a home, there is a large class of people who are simply dealing with the day to day items of life. In fact, if we look at a county like Los Angeles, the most populous county in Southern California 52.1% of households actually rent. This is significant given the population of this county is approximately 10,000,000 people.

This is not as far fetched as you would suspect. The median household income for the entire United States is $46,326.

The median household income for Los Angeles County in 2004 was $43,518 so our hypothetical budget of $46,000 could apply to 5,000,000 people living in this highly populated area. This probably goes against the wide perception that most people in California are wealthy and live in Beverly Hills, Brentwood, or Laguna Beach but this is a very tiny part of the population. This is not the reality. Many of these working families are simply getting by and have little way of accessing the media to discuss their struggles.

In this article, we are going to provide a full monthly budget for either a single person or working couple that pulls in $46,000 a year. Many families live on this amount. In fact, this works out to be about $11 per hour for 2 full-time workers or one worker pulling in $22 per hour. First, let us provide the full monthly budget and discuss the line items in greater detail:

Now I know there have been many budgets put out on various finance and housing sites yet they really do not point you in the right direction as to where to find information. After all, where do you find a fuel economical car for $3,000? Or where can you shop for groceries and pay $400 a month to take care of breakfast, lunch and dinner? We will go into the details of the budget above. Make no mistake, this is a minimalist budget here. You won’t be buying a McMansion here but you won’t be drowning in debt either. With this budget, you are even saving! So if you find yourself in a situation like this, you may want to consider some of the items on the list.

The most expensive line item of any California resident is housing. With $46,000 you shouldn’t even consider buying a home since it will sink you. In fact, many people did buy homes with this kind of budget and now find themselves part of the problems the state is facing. With this kind of budget you have small room for errors. We are giving this person a $1,250 a month allocation for rent. Believe it or not there are many nice 1 bedroom apartments for this price. Craigslist will be one of your tools for investigating rental properties. Take a look at what I found with a quick query:

you have to manage your expectations. You won’t be renting a beach front home in Newport Coast but you also won’t be living in unsafe neighborhoods. Your quality of life will depend on whether you want a studio, 1 bedroom, or 2 bedrooms home. Also, how close to your work would you like to be?

The next tool you’ll be using to find out whether you are paying too much or getting a good deal is Rent-o-meter. With this tool, you simply put the address of the potential rental and it will use Goolge maps to give you a rough estimate of other rentals in the area. For example, let us take a quick look at some rentals in Seal Beach:

After running this quick query, we can determine the market price of homes in this immediate region. Since our budget is sensitive to housing prices, it is important we first manage our expectations in regards to price. But with 88 Cities in Los Angeles County we do have some room for flexibility. It will take some time to research but you will find something safe and comfortable for $1,250 a month.

The next major line item we’ll look at is automobile costs. It is hard to get around California with no car. With the cost of fuel soaring, we won’t be purchasing a Hummer. But you can get a reliable fuel efficient car for $3,000 that will cost no more than $133 a month in fuel even with current gas prices. Where can you find such a deal? Once again we’ll look at Craigslist:

First, you need to realistic about what you can buy. For our example, we are looking at purchasing a 1993 Toyota Corolla. You can probably get a 1994 or go with a Honda Civic of the same year and still fall under your $3,000 budget. These cars if you go with the manual version will get you 35 miles per gallon. You are almost getting the efficiency of a hybrid! Plus, if the car is well maintained these things will last you forever. Let us assume you drive to work 15 miles each way. So you put in 30 miles per day 5 times a week. We’ll give you the same for weekend driving:

7 x 30 miles per day = 210 miles per week x 52 weeks = 10,920 miles per year

Monthly miles 10,920 / 12 = 910 miles per month

910 miles per month / 35 miles per gallon = 26 gallons of gas needed

Cost per gallon $4.25 x 26 = $110.50

We’ll give you another $23 bucks in your budget in case you took a longer trip or added a few additional miles. Or, if prices go up, you have a bit of a cushion up until gas hits $5.11 a gallon which is still a distance away. Liability insurance on these cars is minimal and if you have a good driving record, you can get by with $30 a month.

So now we covered two big line items, your transportation and your housing.

Eating is another major item. With $400 you can feed yourself well for a month. Here in California we are fortunate enough to have regional markets that compete with your common supermarkets. What you’ll find in these regional markets is that produce is nearly 40 to 60% cheaper than your common chain markets. Also, you will find better deals on meats. So this is where you will do your shopping. For items like toothbrushes which can go for $6 at a pharmacy store or supermarket, you can go to the 99 Cent store and get a couple. You will also find that these dollar stores carry many items that you’ll need around your house like tools, cleaning supplies, and snacks. These snacks (like yogurts and nutrition bars) can be part of your brown bag lunch.

For breakfast which you shouldn’t skip, you can have a nutritious cereal with fruit or buy some whole grain waffles for the go. You can make sandwiches for lunch with some chips and fruit and you’re good to go. For dinner, with the produce and meat you can make yourself a solid dinner. Listen, you aren’t going to eat Lobster each night but you aren’t eating Top Ramen either. This is doable if you know how to manage your budget.

Most phone companies are trying to sucker people in trying to have them keep their land lines. They’ll do package deals with DSL or cable which make no sense. You can request to have “naked DSL” which is strictly DSL alone. Many companies provide this and you’ll find reasonable rates where $25 per month will keep you connected to the internet. For phone service you are going to have a pre-paid service with Virgin Mobile or T-Mobile which can be as cheap as $10 per month. Places like Virgin Mobile require you to “top-off” your account each few months but is much cheaper than say going with an iPhone and running yourself down $100 for the service. With one month of iPhone service you can pay for nearly a year of pre-paid service with Virgin Mobile. Again, it is learning to control your spending here.

Many apartments will pay for your trash and water service. Electric will be minimal in most cases since our weather in California is perfect nearly year round. If you must, by a fan or go outside. That is after all why you live in California!

We’ve even provided a line item for clothes. Places like Ross and even Old Navy, provide quality clothes at discount prices. You are not going to be shopping at Macys or Nordstrom’s so get used to it! But it doesn’t mean you have to look poor either.

With $100 for entertainment you have some leeway for what you want to do here. You can go to a few movies a month, eat out a couple of times, or even take a nice camping trip. There are many places in Southern California that are actually free and great. You can go to the Getty (free) or go to the great beaches (free as well).

With this budget, we also haven’t forgotten saving for retirement and also building an emergency fund. We are putting away $250 a month into a Roth IRA since many people that are making $11 an hour don’t have options of saving with their company or employer. If you do, this would be preferable since it is taken out before taxes and will increase your take home pay a bit. It is important to remember that you will need to set something aside for your protection down the road.

With your emergency fund, you will save $300 per month in an ING or Emigrant Direct account. There are other online saving accounts but these places have strong balance sheets and aren’t at risk of going belly up like some institutions here in California. After 1 year, you will have approximately 1.5 months of living expenses saved and after 2 years, you will have 3 months saved. Given that you are also saving in your IRA you should have a minor safety cushion after 2 years. Again, we are emphasizing minimalism here.

This budget is put together from personal experience. I know how hard it is to live in California on a tight budget. Any starving college student will tell you this! In fact, many families are living this on a daily basis. The purpose of this article is to offer at least some hope that you can make it on a lower income. There are ways and resources free of charge that are available to you in helping you reach some form of financial stability. This article isn’t intended to cover every unforeseen circumstances since life itself is unpredictable but it should give you a blue print of living life on a tight budget and not feeling like you have to go into more and more debt. Of course to move higher, most likely you will need to further yourself via an education and fortunately through the community college system and our state schools, education is still relatively affordable and there is financial aid. Knowledge is power and given the hard economic times, regardless of your income you should feel in control of your life.

Source:

Comment