Jan 16, 2011 11:55PM

A Utah court case in which the owner of a Draper townhouse got clear title to the property, even though he still owed $132,000 on it, raises new legal and financial questions about a property-records database created by mortgage bankers.

The award of a title free of liens means that whoever owns the promissory note on the Draper property — likely a group of faraway investors — no longer has the right to foreclose to collect on a delinquent loan. Indeed, the townhouse owner has sold the property and kept the money. Those who own the promissory note probably don’t even know what occurred.

Decisions such as the one 3rd District Judge Glen Iwasaki handed down in the Draper case could have a big impact as the state wends its way through hundreds of lawsuits involving foreclosures, loans on properties for more than they’re worth and predatory lending practices that led Utahns to lose their homes as the real-estate bubble burst.

—

Quiet title » Last year, the owner of the Draper property contacted attorney Walter T. Keane to help him deal with lenders, though Keane won’t say what the problem was and the owner declined an interview request.

Keane filed what’s called a “quiet title action,” a lawsuit in which the owner seeks clear title to a property free of liens by lenders or others.

In Utah, when you take out a mortgage loan to buy a home, you sign a promissory note held by the lender and a deed of trust that is recorded at the county recorder’s office. The promissory note gives the holder the right to collect payments on the loan. The recording of the deed of trust gives the lender the right to foreclose on the property if you default on the loan.

A trustee appointed by the lender also is recorded with the county and actually holds legal title to your property subject to the conditions of the trust deed.

Story continues below

The lawsuit over the title to the townhouse named Garbett Mortgage and Citibank FSB as the holders of promissory notes as recorded on trust deeds filed with the recorder’s office. Integrated Title Services was listed as trustee of the Garbett Mortgage trust deed, while First American Title was the trustee of the CitiBank trust deed.

—

Trust deed tag-along » But there also was another entity listed on the trust deeds called the Mortgage Electronic Registration Systems (MERS). The Mortgage Bankers Association, the Washington, D.C.-based trade group that represents major mortgage lenders, created MERS in the mid-1990s.

MERS is a database where promissory note owners are recorded, with MERS itself then listed on trust deeds at county recorder offices as the “beneficiary” of the note instead of the real lenders or note owners.

The new arrangement greased the way for mortgages to be packaged together and sold to investors who were relieved of the need under the traditional system to record the true owner of the promissory notes and to pay the county recording fees, which average around $35. Attorneys charge MERS is largely an instrument to avoid paying fees every time a promissory note is sold and resold and eventually packaged with others and owned by group of investors.

During the latter part of the real-estate boom, hundreds of thousands of subprime loans were packaged and sold using the MERS system. MERS has registered about 31 million loans, the company’s chief executive said in congressional testimony in November. CEO R.K. Arnold also said in a 2009 deposition that the system had saved its members an estimated $2.4 billion that would have gone to county governments.

—

Who’s the beneficiary? » Under the state’s quiet title laws, Keane said he did not have to name MERS or serve it legal papers in the lawsuit because it was not the legal owner of title to the property. Those were title companies. In addition, attorneys contend, MERS cannot be the “beneficiary” or holder of the promissory note because it readily has admitted it has no financial interest in any notes or mortgages.

Normally, a trustee named in a trust deed has a legal duty in Utah to the entity that holds the promissory note and for fair dealing with the homeowner. But in the townhouse case, First American Title filed a response to the quiet title action saying that it had no idea who had the right to collect payments on the promissory note, nor did it admit to knowing any other basic information about the property.

“The fact of the matter is First American Title doesn’t know who the beneficiary of the trust deed is and basically they disavow any interest in it,” Keane said. “It’s an acknowledgement [the recording system on this property is] a fiction, that they don’t have any real interest in it.”

Garbett Mortgage also told the court it no longer held an interest in the property. Integrated Title never filed a response to the lawsuit but did withdraw as a trustee with the Salt Lake County Recorder’s Office.

“Considering the owner of the property [the title companies who were trustees] failed to dispute the matter, and further considering that the original lender claims no further interest, the court nullified the trust deeds prior to setting any type of trial date,” Keane said.

So in the four months that the process took, the owner was able to gain title and deny the owners of his loan the ability to foreclose on the property for nonpayment. That means the promissory note owned by investors may be worth far less than they paid for it because it is no longer backed by an asset.

—

Record reliability » MERS spokeswoman Karmelo Lejarde said MERS actually added reliability to the system of county recording offices.

“Prior to the creation of MERS [when servicers routinely held the mortgage lien for the note owner], the information in the public land records was not accurate due to delays in recording assignments or missing assignments that never got recorded,” she said in e-mail that appears to be a boilerplate response to questions about MERS’ role in the nation’s property registration system.

“With the MERS System, mortgage data is more accurate and title information more reliable. The MERS process creates accountability and transparency, helps keep costs low, reduces the risk of errors in record keeping and makes it easier to keep track of the lien if a loan is sold to other banks and investors.”

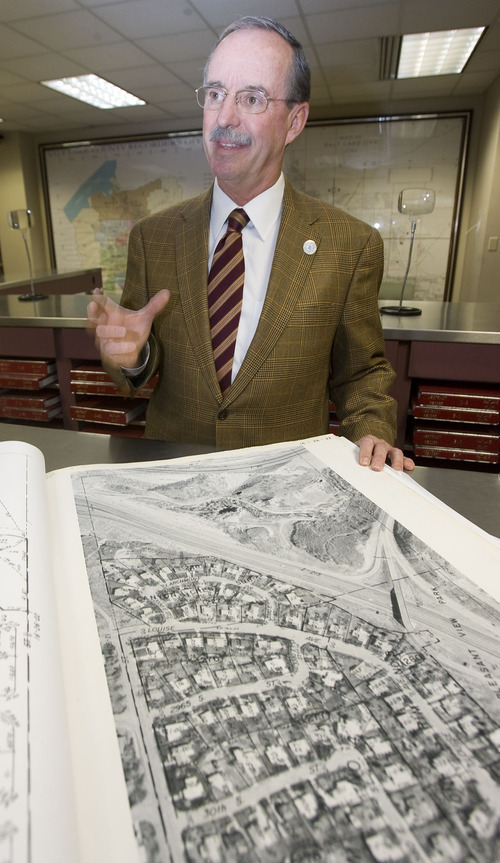

Gary Ott, the elected Salt Lake County recorder for the past 10 years, disagrees. He characterizes his office as a neutral party that permanently safeguards records, all of which are available for public inspection. In the past, parties were able to record each transaction or lien involving a property so a clear picture emerges of the title history of a property, Ott said, adding that with computerization, the recording is now nearly instantaneous once documents are received by his office.

“You can trust what you see at the recorder’s office because it’s up to this date, everything is in order,” said Ott, “and you can’t see at MERS if it’s in order at all. That’s the scary part, and people’s homes are something you shouldn’t mess with.”

—

Default judgment • Keane said he’s been able to obtain quiet title in the same manner in two other cases. Another attorney, Abraham Bates, said he recently also won a quiet title action in a similar case in Salt Lake County.

In Bates’ case, a couple who owed $417,000 on a house whose value had dropped way below that also sued for quiet title.

He named the original lender and a title company listed as trustee on the trust deed. Because neither responded to the lawsuit as legally required, the judge granted the couple a default judgment that still must be verified in court, Bates said.

Bates said under Utah laws, it was not necessary to serve MERS legal papers, as it was not in the Draper townhouse case.

“MERS is not the beneficiary of the trust deed,” Bates said. “MERS did not make the mortgage loan.”

—

New questions » While these decisions stripped the owners of the promissory notes of the ability to foreclose on the property to recoup missed payments, it does not preclude them from suing the people who signed the notes to try to recover lost monies.

But that action would open up a new line of questions about the MERS method of property recording, said Christopher Peterson, a University of Utah law professor who has made a national name for himself recently by questioning the legal foundations of MERS’ appearance in property-recording records and its role in foreclosures.

Under laws adopted by all 50 states, the owner of a “negotiable instrument” such as a promissory note must be in physical possession of the document, said Peterson. Otherwise it would be like someone trying to cash a photocopy of a check instead of the actual check.

“One cannot be a holder of a note unless one is in physical possession of that note,” he said.

But Peterson said evidence is coming out in courts that shows the actual promissory notes or mortgages signed by buyers were not transferred as the notes made their way into the mortgage-backed securities investment pools.

That could mean in these cases that no one is in a position to try to collect because the actual notes are lost or destroyed, potentially making some promissory notes investors think they hold worthless.

Right to foreclose • Bates said he has more than 100 lawsuits pending over MERS-related questions and has hired more attorneys for his firm to handle the increasing load.

State courts have been more favorable than federal courts to homeowners seeking to halt foreclosure proceedings based on questions about MERS’ legal standing under state and federal laws, the attorneys say.

Rulings have gone different ways in different courts. But Bates said he and Peterson are teaming up to appeal a recent ruling by U.S. District Judge Tena Campbell that dismissed a lawsuit claiming MERS did not have the legal right to initiate foreclosure proceedings.

The attorneys are appealing Campell’s ruling as it relates to Utah law to the Utah Supreme Court. A decision will help sort out the issues with MERS over whether it actually can initiate foreclosures even if it does not have any financial interest in the promissory note, Bates said.

A ruling favorable to the homeowner “would be an absolute tsunami in terms of foreclosure in the state of Utah,” he said.

If MERS is not able to start a foreclosure action, “then there will be a brick wall put up over all nonjudicial foreclosures prosecuted in this state,” Bates said.

A Utah court case in which the owner of a Draper townhouse got clear title to the property, even though he still owed $132,000 on it, raises new legal and financial questions about a property-records database created by mortgage bankers.

The award of a title free of liens means that whoever owns the promissory note on the Draper property — likely a group of faraway investors — no longer has the right to foreclose to collect on a delinquent loan. Indeed, the townhouse owner has sold the property and kept the money. Those who own the promissory note probably don’t even know what occurred.

Decisions such as the one 3rd District Judge Glen Iwasaki handed down in the Draper case could have a big impact as the state wends its way through hundreds of lawsuits involving foreclosures, loans on properties for more than they’re worth and predatory lending practices that led Utahns to lose their homes as the real-estate bubble burst.

—

Quiet title » Last year, the owner of the Draper property contacted attorney Walter T. Keane to help him deal with lenders, though Keane won’t say what the problem was and the owner declined an interview request.

Keane filed what’s called a “quiet title action,” a lawsuit in which the owner seeks clear title to a property free of liens by lenders or others.

In Utah, when you take out a mortgage loan to buy a home, you sign a promissory note held by the lender and a deed of trust that is recorded at the county recorder’s office. The promissory note gives the holder the right to collect payments on the loan. The recording of the deed of trust gives the lender the right to foreclose on the property if you default on the loan.

A trustee appointed by the lender also is recorded with the county and actually holds legal title to your property subject to the conditions of the trust deed.

Story continues below

The lawsuit over the title to the townhouse named Garbett Mortgage and Citibank FSB as the holders of promissory notes as recorded on trust deeds filed with the recorder’s office. Integrated Title Services was listed as trustee of the Garbett Mortgage trust deed, while First American Title was the trustee of the CitiBank trust deed.

—

Trust deed tag-along » But there also was another entity listed on the trust deeds called the Mortgage Electronic Registration Systems (MERS). The Mortgage Bankers Association, the Washington, D.C.-based trade group that represents major mortgage lenders, created MERS in the mid-1990s.

MERS is a database where promissory note owners are recorded, with MERS itself then listed on trust deeds at county recorder offices as the “beneficiary” of the note instead of the real lenders or note owners.

The new arrangement greased the way for mortgages to be packaged together and sold to investors who were relieved of the need under the traditional system to record the true owner of the promissory notes and to pay the county recording fees, which average around $35. Attorneys charge MERS is largely an instrument to avoid paying fees every time a promissory note is sold and resold and eventually packaged with others and owned by group of investors.

During the latter part of the real-estate boom, hundreds of thousands of subprime loans were packaged and sold using the MERS system. MERS has registered about 31 million loans, the company’s chief executive said in congressional testimony in November. CEO R.K. Arnold also said in a 2009 deposition that the system had saved its members an estimated $2.4 billion that would have gone to county governments.

—

Who’s the beneficiary? » Under the state’s quiet title laws, Keane said he did not have to name MERS or serve it legal papers in the lawsuit because it was not the legal owner of title to the property. Those were title companies. In addition, attorneys contend, MERS cannot be the “beneficiary” or holder of the promissory note because it readily has admitted it has no financial interest in any notes or mortgages.

Normally, a trustee named in a trust deed has a legal duty in Utah to the entity that holds the promissory note and for fair dealing with the homeowner. But in the townhouse case, First American Title filed a response to the quiet title action saying that it had no idea who had the right to collect payments on the promissory note, nor did it admit to knowing any other basic information about the property.

“The fact of the matter is First American Title doesn’t know who the beneficiary of the trust deed is and basically they disavow any interest in it,” Keane said. “It’s an acknowledgement [the recording system on this property is] a fiction, that they don’t have any real interest in it.”

Garbett Mortgage also told the court it no longer held an interest in the property. Integrated Title never filed a response to the lawsuit but did withdraw as a trustee with the Salt Lake County Recorder’s Office.

“Considering the owner of the property [the title companies who were trustees] failed to dispute the matter, and further considering that the original lender claims no further interest, the court nullified the trust deeds prior to setting any type of trial date,” Keane said.

So in the four months that the process took, the owner was able to gain title and deny the owners of his loan the ability to foreclose on the property for nonpayment. That means the promissory note owned by investors may be worth far less than they paid for it because it is no longer backed by an asset.

—

Record reliability » MERS spokeswoman Karmelo Lejarde said MERS actually added reliability to the system of county recording offices.

“Prior to the creation of MERS [when servicers routinely held the mortgage lien for the note owner], the information in the public land records was not accurate due to delays in recording assignments or missing assignments that never got recorded,” she said in e-mail that appears to be a boilerplate response to questions about MERS’ role in the nation’s property registration system.

“With the MERS System, mortgage data is more accurate and title information more reliable. The MERS process creates accountability and transparency, helps keep costs low, reduces the risk of errors in record keeping and makes it easier to keep track of the lien if a loan is sold to other banks and investors.”

Gary Ott, the elected Salt Lake County recorder for the past 10 years, disagrees. He characterizes his office as a neutral party that permanently safeguards records, all of which are available for public inspection. In the past, parties were able to record each transaction or lien involving a property so a clear picture emerges of the title history of a property, Ott said, adding that with computerization, the recording is now nearly instantaneous once documents are received by his office.

“You can trust what you see at the recorder’s office because it’s up to this date, everything is in order,” said Ott, “and you can’t see at MERS if it’s in order at all. That’s the scary part, and people’s homes are something you shouldn’t mess with.”

—

Default judgment • Keane said he’s been able to obtain quiet title in the same manner in two other cases. Another attorney, Abraham Bates, said he recently also won a quiet title action in a similar case in Salt Lake County.

In Bates’ case, a couple who owed $417,000 on a house whose value had dropped way below that also sued for quiet title.

He named the original lender and a title company listed as trustee on the trust deed. Because neither responded to the lawsuit as legally required, the judge granted the couple a default judgment that still must be verified in court, Bates said.

Bates said under Utah laws, it was not necessary to serve MERS legal papers, as it was not in the Draper townhouse case.

“MERS is not the beneficiary of the trust deed,” Bates said. “MERS did not make the mortgage loan.”

—

New questions » While these decisions stripped the owners of the promissory notes of the ability to foreclose on the property to recoup missed payments, it does not preclude them from suing the people who signed the notes to try to recover lost monies.

But that action would open up a new line of questions about the MERS method of property recording, said Christopher Peterson, a University of Utah law professor who has made a national name for himself recently by questioning the legal foundations of MERS’ appearance in property-recording records and its role in foreclosures.

Under laws adopted by all 50 states, the owner of a “negotiable instrument” such as a promissory note must be in physical possession of the document, said Peterson. Otherwise it would be like someone trying to cash a photocopy of a check instead of the actual check.

“One cannot be a holder of a note unless one is in physical possession of that note,” he said.

But Peterson said evidence is coming out in courts that shows the actual promissory notes or mortgages signed by buyers were not transferred as the notes made their way into the mortgage-backed securities investment pools.

That could mean in these cases that no one is in a position to try to collect because the actual notes are lost or destroyed, potentially making some promissory notes investors think they hold worthless.

Right to foreclose • Bates said he has more than 100 lawsuits pending over MERS-related questions and has hired more attorneys for his firm to handle the increasing load.

State courts have been more favorable than federal courts to homeowners seeking to halt foreclosure proceedings based on questions about MERS’ legal standing under state and federal laws, the attorneys say.

Rulings have gone different ways in different courts. But Bates said he and Peterson are teaming up to appeal a recent ruling by U.S. District Judge Tena Campbell that dismissed a lawsuit claiming MERS did not have the legal right to initiate foreclosure proceedings.

The attorneys are appealing Campell’s ruling as it relates to Utah law to the Utah Supreme Court. A decision will help sort out the issues with MERS over whether it actually can initiate foreclosures even if it does not have any financial interest in the promissory note, Bates said.

A ruling favorable to the homeowner “would be an absolute tsunami in terms of foreclosure in the state of Utah,” he said.

If MERS is not able to start a foreclosure action, “then there will be a brick wall put up over all nonjudicial foreclosures prosecuted in this state,” Bates said.

MAKE SURE AND VISIT Tobee's Blogs!

MAKE SURE AND VISIT Tobee's Blogs!  Bring it on! ** 341 - Scheduled for 6/6/11 that wasn't so bad, but continued

Bring it on! ** 341 - Scheduled for 6/6/11 that wasn't so bad, but continued  **Discharge - (after 8/5/11)

**Discharge - (after 8/5/11)

Comment