top Ad Widget

Collapse

Announcement

Collapse

No announcement yet.

Has anyone paid Trustee to keep your car?

Collapse

X

-

In response to:

"Example

13700 car value

7500 loan amount

15% interest left on the loan 1125

6375 is the principle balance left on the car

13700-6375 = 7325 in equity is what you would have on the vehicle."

Wouldn't just be easier to call the lender and ask for a payoff quote and then subtract that from the value to calculate equity, or lack thereof since most of us are upside down? I hate math.

Comment

-

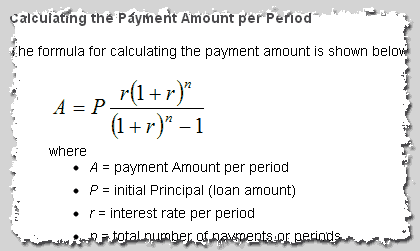

You would think, but if you read on the paperwork you signed there is a mathematical equation they use. Using simple addition and subtraction will not get the exact answer you are looking for. I hate doing mathematical equations, but it is a fact of life now. I have to admit I hated taking stats in college, but it is coming in handy in figuring out financial formula's.Chapter 7 filed on 4/23/2010

341 meeting on 5/28/2010

Discharged on 8/19/2010

Comment

-

I said the same thing when I read my loan app for my car that I had financed. Maybe I should have taken it to a local college and had the professor explain it to me in simple terms. I doubt I could even work that formula. I guess that is one good thing about having computers input the formula for you.

Also I think companies use this formula to confuse people. Most people could not read these formula's, much less try to calculate the proper answer. I would pull my hair out if I had to work in the financial sector.Chapter 7 filed on 4/23/2010

341 meeting on 5/28/2010

Discharged on 8/19/2010

Comment

-

tiny vehicle exemption

Hi 2bdebtfree,

What state are you in that has such a measly vehicle exemption?

Hi ferfermom,

WA has a $2,500 vehicle exemption (doubled if filing jointly) ...and WA is one of the nice states that allow you to use federal exemptions...where the vehicle exemption is $3,225 (doubled if filing jointly)

Hi all,

Some of the discussion triggered a thought....if the trustee sells the car at a public auction...my experience w/ car auctions around here is that cars sell for about 1/2 to 2/3 KBB value (unless it is a special classic, sports car, or something)....maybe this is why some folks pay a fraction and get the car back?

Just a thought,

Tom in ColoCh7 filed 5/12/2010.....341 meeting 6/30/2010....report of no distribution 8/15/2010.....discharged 10/01/2010.....closed 11/09/2010

Comment

-

I live in Massachusetts. The homestead is $500,000 but the vehicle exemption is $700. I need to protect the equity in my home. We have no wildcard here to put the car in.

The homestead is $500,000 but the vehicle exemption is $700. I need to protect the equity in my home. We have no wildcard here to put the car in.

Hopefully, I can get a used car dealer to value my car lower and the Trustee will accept that amount instead of KBB value.

I retained my attorney yesterday. Should file in December.

Comment

-

I had a paid off 3 year old car which I couldn't compleatly exempt. Book value was 8500.00 exemption was 2500.00 difference of 6000.00 I offered the trustee 4000.00 over 10 months. He accepted. All this was done through my attorney. It's now mine again and will go to my daughter when she graduates college. I held the title with no lein throughout the entire payment process. Offer two thirds of the non exempt value. Trustee should accept. My case is still open some 300 days since my discharge due to a land asset that may never sell. I might buy that back too if its not abandoned back to me. Full story when I'm closed. By the way there is no intrest paid to the trustee.

Comment

-

Massachusetts

Hi 2bdebtfree,

If you had me guess which state had a $700 vehicle exemption, MA would not even make the list. They seem so good about consumer protection!

Tom in ColoCh7 filed 5/12/2010.....341 meeting 6/30/2010....report of no distribution 8/15/2010.....discharged 10/01/2010.....closed 11/09/2010

Comment

-

Originally posted by tcreegan View PostHi 2bdebtfree,

What state are you in that has such a measly vehicle exemption?

Hi ferfermom,

WA has a $2,500 vehicle exemption (doubled if filing jointly) ...and WA is one of the nice states that allow you to use federal exemptions...where the vehicle exemption is $3,225 (doubled if filing jointly)

Hi all,

Some of the discussion triggered a thought....if the trustee sells the car at a public auction...my experience w/ car auctions around here is that cars sell for about 1/2 to 2/3 KBB value (unless it is a special classic, sports car, or something)....maybe this is why some folks pay a fraction and get the car back?

Just a thought,

Tom in ColoChapter 7 filed 11/4/10 ---- 341 Meeting 12/1/10 ---- Discharge 1/31/2011.

Comment

bottom Ad Widget

Collapse

341 on September 23

341 on September 23

Comment